If the stock is trading at a market price of $170, for example, the trader has a profit of $6 (breakeven of $176 minus the current market price of $170). At that breakeven price, the homeowner would exactly break even, neither making nor losing any money. Compare cost, overheads and business factors again return to calculate your break even point when selling multiple items/products. A unit ties back to what you entered for the “selling price per unit.” If you are a house painter, and your average price for painting a house is $7,000, a break-even analysis will calculate how many homes you must paint each month to cover your costs. Also calculates fixed, variable, and component costs as a percentage of sales.

Is there any other context you can provide?

While this could boost foot traffic, it also means your break-even point will change and you’ll need to sell more drinks to reach profitability. That’s the difference between the number of units required to meet a profit goal and the required units that must be sold to cover the expenses. In our example, Barbara had to produce and sell 2,500 units to cover the factory expenditures and had to produce 3,500 units in order to meet her profit objectives. It’s the amount of sales the company can afford to lose but still cover its expenditures. This computes the total number of units that must be sold in order for the company to generate enough revenues to cover all of its expenses. One business’s fixed costs could be another business’s variable cost.

Formula

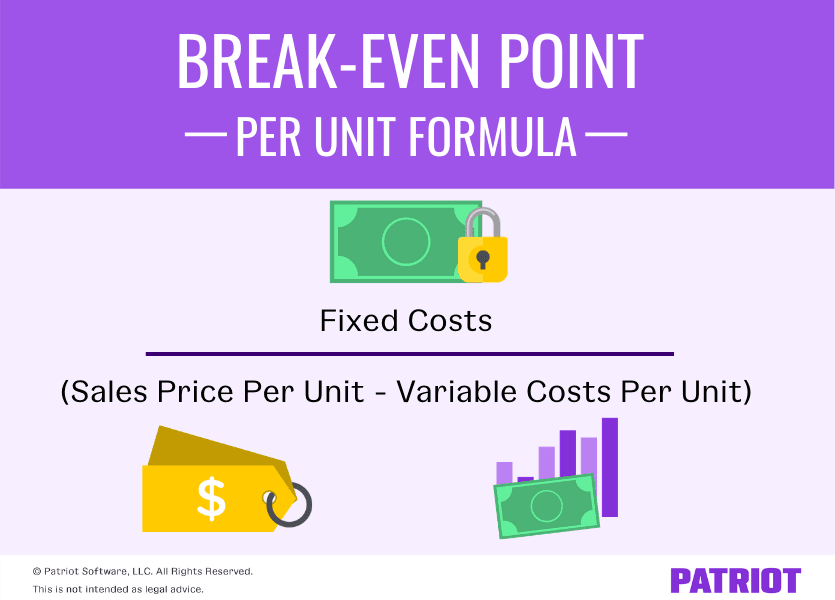

This can be converted into units by calculating the contribution margin (unit sale price less variable costs). Dividing the fixed costs by the contribution margin will reveal how many units are needed to break even. The break-even point formula is calculated by dividing the total fixed costs of production by the price per unit less the variable costs to produce the product. The break-even point is calculated by dividing your fixed costs by the difference between the sales price per unit and the variable cost per unit.

Can the break-even point be used to predict future profits?

The fixed costs are a total of all FC, whereas the price and variable costs are measured per unit. Break-even analysis can also be a great way to measure and benchmark your business’s performance over time. Over the past couple of months, you’ve consistently sold 400 units, meaning you’re exceeding your goal and generating profit. On the other hand, if you’re only selling 250 units, you’ll need to either increase sales or lower costs to hit that target. Tracking this data over time can help you identify patterns — e.g., slower sales during specific months — so you can adjust your strategy based on those trends.

Manfaat BEP dalam Bisnis

If the stock is trading below this, then the benefit of the option has not exceeded its cost. The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even analysis to measure its repayment of debt or how long that repayment will take. Variable costs are those items that change over time and are not required. The amount a business spends on advertising can increase, decrease. Or the business can even eliminate advertising from one period to the next.

Do you already work with a financial advisor?

Break even point analysis is an important part of planning any start up. It is that point of time when your business has generated enough revenue to cover your initial cost. It also covers any fixed and variable costs incurred on a monthly basis. Once you have reached the break even point, any additional income generated after that point could be considered as profit. The Break Even Revenue Calculator is a useful tool for businesses to determine the amount of revenue they need to generate in order to cover their operating expenses. By understanding your break-even point, you can make better decisions about pricing, sales targets, and cost management.

- Since Jill wants to know how many hours she needs to bill a month, she will enter all expenses as monthly expenses.

- Hypothetical illustrations may provide historical or current performance information.

- This calculator allows you to calculate the required revenue to cover all your costs based on your operating expenses and gross margin percentage.

- Yes, by understanding your Break-Even Point, you can make informed decisions about pricing your products and controlling your costs to improve profitability.

- The calculation is useful when trading in or creating a strategy to buy options or a fixed-income security product.

For example, If your startup costs are $50,000 and your product sells for $50 with a $20 production cost, break-even analysis shows you’ll need to sell roughly 1,700 units to cover your expenses. From there, you can decide on pricing, production, and sales targets so your business can stay on the right track from property and equipment definition the get-go. Production managers and executives have to be keenly aware of their level of sales and how close they are to covering fixed and variable costs at all times. That’s why they constantly try to change elements in the formulas reduce the number of units need to produce and increase profitability.

A break-even analysis relies on three crucial aspects of a business operation – selling price of a unit, fixed costs and variable costs. On the other hand, variable costs are largely dependent on the volume of work at hand – if you have more clients, you will need more labor and materials which results in an increase in variable expenses. Typically, this analysis works best for businesses that focus on a single product or service. The analysis becomes more complex and less accurate if you offer a wide range of products with different price points and variable costs. For example, If you sell both high-end electronics and low-cost accessories, a single break-even analysis won’t account for the differing profit margins. You’d need individual analyses for each product category to get a more accurate picture of your profitability.

This tells you the number of units you need to sell to break even. The break-even point is the sales level at which total revenues equal total costs, meaning the business neither makes a profit nor incurs a loss. It’s a crucial metric for business owners to determine how many units of a product or services they need to sell to cover all their costs. The Break Even Revenue Calculator is a vital tool for understanding how much revenue you need to generate in order to cover your operating expenses. By using the formula to calculate your break-even revenue, you can make informed decisions about pricing, cost-cutting measures, and sales targets. Whether you are a small startup or an established business, calculating your break-even point helps ensure your business stays profitable and financially sound.